Succinct Summation of Weeks Events 11.16.18

Succinct Summations for the week ending November 16th, 2018

Positives:

1. The FOMC seemsready to pause raising rates for a meeting;

2. WTI Oil prices have completed a round trip, falling back to where they were in in 2017.

3. Retail sales rose 0.8% in October, exceeding the expected 0.5% increase; Same store sales rose 6.1% w/o/w for the second week in a row.

4. CPI rose 0.3% m/o/m, meeting expectations.

5. Business inventories rose 0.3% m/o/m, meeting expectations.

Negatives:

1. Brexit mayhem is a fresh reminder that European alliances are fraying under the combined weight of popularism and agnotology.

2. The 30 yrmortgage rate hit 5.17% — an 8 1/2 year high.

3. Jobless claims rose 2k w/o/w, from 214k to 216k.

4. Import and export prices rose 0.5% and 0.4% m/o/m.

5.Mortgage applications fell a seasonally-adjusted 2.3% w/o/w, reaching the lowest level since February 2017.

Sun 11-18-18 10 Weekend Reads - The Big Picture

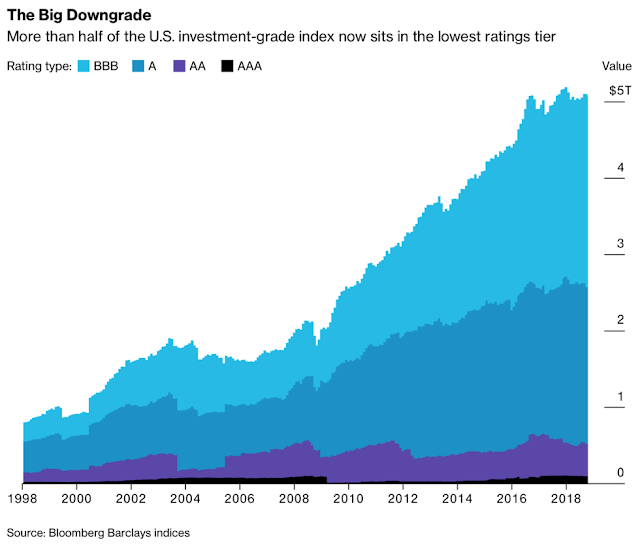

After GE, Investors Are Watching These Debt-Laden

No comments:

Post a Comment