4-17-19 Morpheus: How To Trade During Earnings Season

How To Trade During Earnings Season

�

Breakaway GAPS�

Earnings season is back, so we’d like to review one our our favorite buy setups in play during earnings season, the breakaway gap up. Breakaway gap ups are extremely powerful and can often lead to significant gains in a short period of time.

A breakaway gap up occurs when a stock gaps open above the highs of a trading range. The trading range should be at least five weeks in length but the 3-9 months is the average. The gap up should be to a new 52-week high, or even better a new all-time high.

Volume is extremely important when deciding to buy a gap up. The best breakaway gap ups will often close up 10% or more on volume that is 5 times greater than average. Many gap ups will close with volume that is 8-13 times greater than average.

The way we like to play a breakaway gap up is pretty aggressive, as we want to enter within the first few minutes of trading on the open. A breakout above the 1-minute or 5-minute highs work best. The idea here is to wait and see if there is strength on the open and then buy.

Since the entry is within a few minutes of the open, we have no way of knowing if volume will close 5-10x higher than average. However, if volume is obviously very strong during the first 15-minutes of trading (or strong pre-market), then we will take the trade. If volume is 40% of the day’s average during the first 30-minutes of trading that is a good sign. If volume is 100% of the day’s average during the first hour that is a great sign.

Stop placement is pretty simple. We place a stop 5% below the open. That’s it. Strong gap ups should not dip much below the open on the day of the gap up. However, some stocks that do not move higher immediately may undercut the low of the breakaway gap up day, so the 5% stop should give us a bit of wiggle room most of the time.

Many traders shy away from buying gaps as the stock is already up 10-20% on the open, which can be intimidating. However, through the years we have seen many examples of where the gap is not filled and the stock goes on a multi-month rally.

Here are a few examples:

$TTD’s breakaway gap up from a 6-month long base was confirmed by huge volume. The entry is near the open as mentioned above, using a 1 or 5-minute high. We mention the 1-minute high because the 5-minute high may be a bit too late on some of the faster trading stocks.

Gap ups that close strong are preferred. If the close of the gap up day is in the bottom half of the day’s range then the stock may be vulnerable to an undercut of the gap up day low within the next few days.

If the price breaks through the highs of the the gap up day within a few days, then it could have a decent shot of moving much higher in the short term. This is also true if the price holds above the 10-day MA. A break of the 10-day MA would suggest the stock needs a bit more sideways action before going higher and possibly a test of the 20-day EMA.

In the example below, $TTD follows through to the upside quickly and remains above the 10-day MA for several weeks.

Not all gap ups move out right away.

$TSLA failed to hold the lows of the gap up day (A) and pulled back into the rising 10-day MA (B). We purchased $TSLA off the 10-day MA in our nightly report The Wagner Daily which turned into a big winner for us in 2013. Although it may not look like it, the low of the pullback to the 10-day MA did not violate a stop placed 5% below the open of the gap. Even if we miss a breakaway gap we are always looking to enter on weakness or strength if a low-risk buy point develops.

$SQ’s breakaway gap up led to a monster rally in 2017. However, the gap up buy did not lead to big gains right away as the price failed to hold above the close of the gap day (a), the 10-day MA (b), as then undercut the 20-day EMA at (c). Failing to hold the 10-day MA increases the odds for more chop.

Generally speaking, one can stick with the stock as long as it holds the 20-day EMA unless there is a significant run up within a short period of time, allowing for an exit into strength.

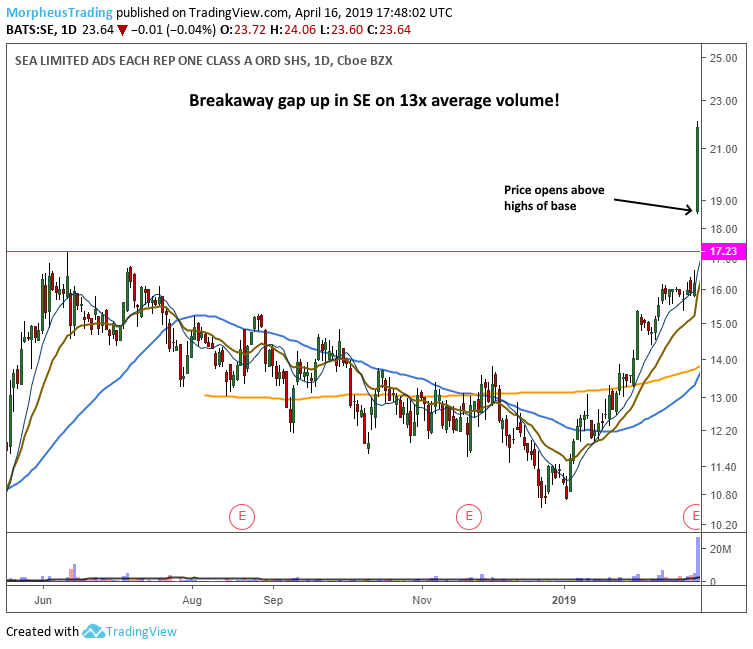

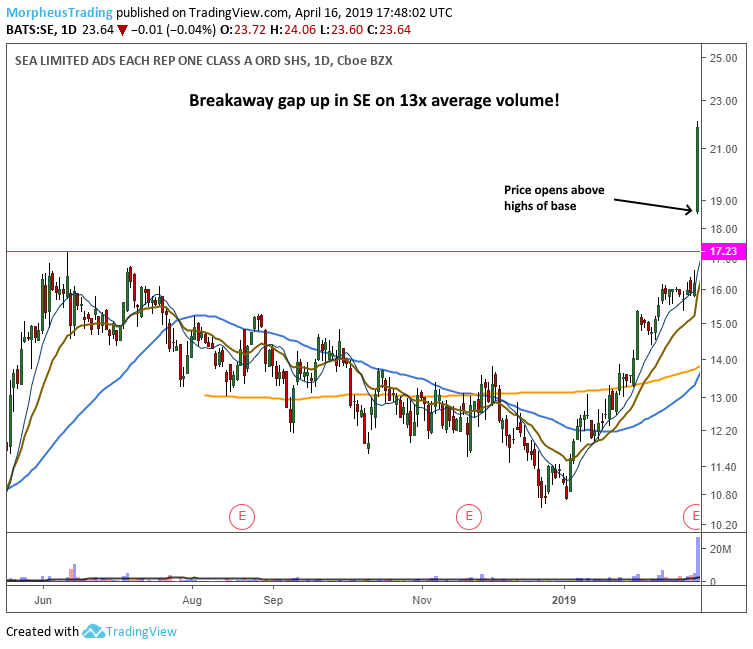

Our last example of a breakaway gap is $SE, which was a recent gap up to new all-time highs. From the open the price ripped higher, closing with a near 20% gain from the open on big volume.

$SE rallied 35% higher from the opening gap up in 5 days, which was a bit too much too soon. A break of the 10-day MA signaled that the price may need to chop around for a while, which it is now doing near the 20-day EMA. As long as the price holds the 20-day EMA $SE should be monitored for a low-rissk buy point.

Earnings season is the time to be on the lookout for breakaway gap ups. Aggressive traders who watch the market intraday can buy the open if volume is strong in pre-market trading. All swing and position traders should monitor a list of breakaway gap ups for low-risk buy points, as they can lead to explosive moves down the road if not right away.

Sign up now to receive your real-time trade alerts, hot stock picks, and educational market analysis included with your Wagner Daily subscription.

No comments:

Post a Comment