For your reading this weekend, I submit the latest posting from the AAII, this one on the ins and outs of convertible bonds. I never really understood convertibles until I took a seminar a few years back at the Financial Planning Association (FPA) of Michigan. It was very impressive and made you wonder why anyone would want to invest in anything else. After all, convertibles gave you the best of both worlds -- the growth of equities when the market was up and the yield of bonds when down. And the investor gets to decide which to take when it's time to cash in. This is a win-win. (As always, you do need to be an AAII member to read the entire article.) Have a great weekend.

Inside Convertible Bonds: An Attractive Risk/Return Tradeoff

by Brian Haughey

Featured Tickers: CCVIX, CWB, F, QQQ, QQQ, SPY, TSLA

Investors optimistic about the prospects for a given firm will often purchase its shares, hoping that as its earnings improve so too will its stock price. If correct, these investors can earn significant returns, but they face the risk that the company’s future performance will disappoint, or that there will be a broad market sell-off, either of which may lead to a significant decrease in the firm’s stock price.

More risk-averse investors, on the other hand, may buy the firm’s bonds. Since bondholders are senior to shareholders, they will receive interest and principal before any dividends are paid. Investors in these fixed-income instruments will receive exactly what they were promised—no more and no less, unless the firm defaults—although their total return will also depend on any changes in interest rates.

Suppose that you are considering investing in a firm with uncertain prospects, such as a pharmaceutical company awaiting the results of a drug trial. If the drug is successful and receives approval from the U.S. Food and Drug Administration (FDA), the firm’s stock price may soar. On the other hand, if the drug turns out to be ineffective, the stock price is likely to fall, although you believe the firm would still be able to pay the interest and principal on its bonds. Should you buy the stock, and profit from any upside, or buy the bond and collect coupon payments? In the best of worlds you could do both and, if the firm issues convertible bonds, you can.

Related

The Basics of Convertible Bonds

Convertible bonds, or converts, are hybrid securities that combine the potential price appreciation of equity with the income of bonds. A convertible bond incorporates an equity call option through which the owner can surrender the bond in return for a specified number of common shares, while an exchangeable bond can be exchanged for shares in a different firm. The number of shares is fixed when the bond is issued but will be adjusted in the event of a stock split. Many convertibles carry a coupon that is higher than the dividend yield on the firm’s equity.

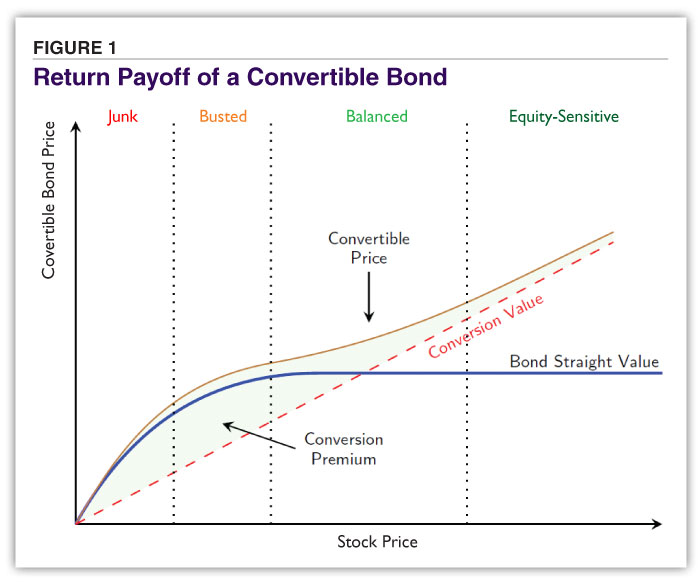

Due to its embedded equity call option, a convertible bond has an asymmetric return payoff. If the stock price falls, or fails to appreciate much, the convertible bond is referred to as busted. The bond will behave as if it were a plain, non-convertible bond trading at its straight value (the market value the bond would have if it didn’t have the convertible option). If an increased risk of bankruptcy causes the stock price to fall dramatically, the bond is likely to be downgraded to junk status, and its price will also drop sharply.

On the other hand, if the stock price increases, the bond becomes equity-sensitive, since it is likely that the bondholder will choose to convert the bond. Eventually the bond price will approach parity, when it equals the value of the shares into which it can be converted, which is its conversion value. Figure 1 illustrates the various payoff scenarios.

Convertible investors are willing to pay a premium relative to the bond’s conversion value that, in recent years, averaged 30% at issuance. After issuance, convertibles can continue to trade at a premium to the value of the underlying equity. There are several factors that drive the premium, including the volatility of the underlying stock price, as well as the difference between the bond’s coupon and any dividend the equity investor may receive.

Of course, there’s no such thing as a free lunch, and an investor has to pay for the conversion option included in the convertible bond. The cost is reflected in the bond’s coupon, which is lower than would be available on an otherwise equivalent non-convertible, or straight, bond. This interest savings is one reason why younger, or less highly rated, firms choose to issue these bonds. Another reason is that the firm may wish to issue equity but prefers to wait for its share price to rise before doing so.

Not all convertible bonds are the same. Most have a hard call feature (not to be confused with the embedded equity call) that allows the issuer to redeem them early, forcing the bondholder to convert and to forgo accrued interest. Those with a soft, or contingent, call provision may be converted only if the stock reaches a trigger price. Those with a put feature can be redeemed early by the bondholder, often on specific dates, for example in the event that the issuing firm is acquired. Some convertibles can include multiple features: For example, a liquid yield option note (LYON) is a zero-coupon bond that is convertible, callable and puttable.

Convertible bonds comprise a comparatively small segment of the $11 trillion U.S. corporate bond market, with $247 billion outstanding in April 2021, according to Bloomberg. One recent example of the type is the five-year, $2.3 billion convertible bond issued in March 2021 by Ford Motor Co. (F). Carrying a coupon of 0%, each bond has a face value of $1,000 and a conversion ratio of 57.1886, meaning that if converted the holder will receive that number of shares in lieu of any further bond cash flows. The conversion price, or price at which the bondholder will receive the shares, is therefore $1,000 ÷ 57.1886, or $17.486.

Ford’s share price the day before the announcement was about $13.20, so the bond’s initial equity premium was 32%. Unsurprisingly, Ford’s share price dropped upon the announcement because—if converted—the bond will result in new shares being issued, diluting those of existing shareholders. As with many oversubscribed issues, Ford took advantage of a greenshoe option to increase the issue size by 15%. (A greenshoe option allows the underwriters to sell additional shares or bonds in an offering. It is typically used if demand for an offering is high.)

Performance of Convertible Bonds

When equity price volatility leads to significant price appreciation, convertible bondholders can benefit accordingly. For example, Tesla Inc. (TSLA) issued a 2% five-year convertible bond in May 2019 with a par value of $1,000. The conversion ratio was 16.138, so that the stock could be acquired at a conversion price of $61.97. In late April 2021, with Tesla stock trading at $736, the $1,000 bond could potentially be surrendered for stock worth $11,878 ($736 × 16.138), a dramatic return in two years.

It is not just the convertible bonds of firms such as Tesla that offer impressive returns. In general, all convertible bonds will benefit from rising equity markets. In the five years through December 2020, for example, the SPDR Bloomberg Barclays Convertible Securities ETF (CWB) had an annual total return of 18.65%, versus the 15.09% returned by the SPDR S&P 500 ETF Trust (SPY). However, the SPDR Bloomberg Barclays Convertible Securities ETF did underperform the 23.97% returned annually by the technology-heavy Invesco QQQ Trust Series 1 (QQQ). In the volatile year of 2020 alone, the SPDR Bloomberg Barclays Convertible Securities ETF returned 53.2%, slightly more than the Invesco QQQ Trust’s 48.5% and trouncing the SPDR S&P 500 ETF Trust’s return of 18.3%.

Bear Market Returns

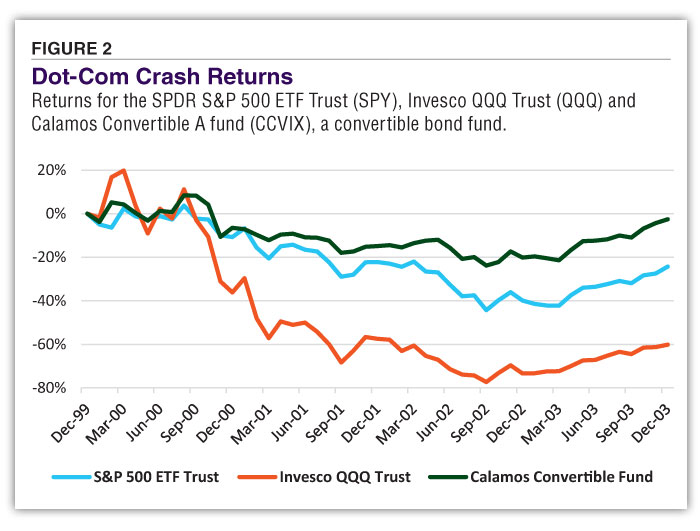

Convertibles perform well in bear markets as well as bull markets, as seen during the collapse of the dot-com bubble. Between 2000 and 2003, the Class A shares of the Calamos Convertible Fund (CCVIX) decreased by just 2.57%, in contrast to the 24% price decrease experienced by the SPDR S&P 500 ETF Trust and the 60% plunge suffered by the Invesco QQQ Trust, which reflects the performance of Nasdaq 100 stocks. When coupon payments are included, the convertible fund had a cumulative total return of 22.3% over the period, corresponding to an average annual return of 5.16% as shown in Figure 2.

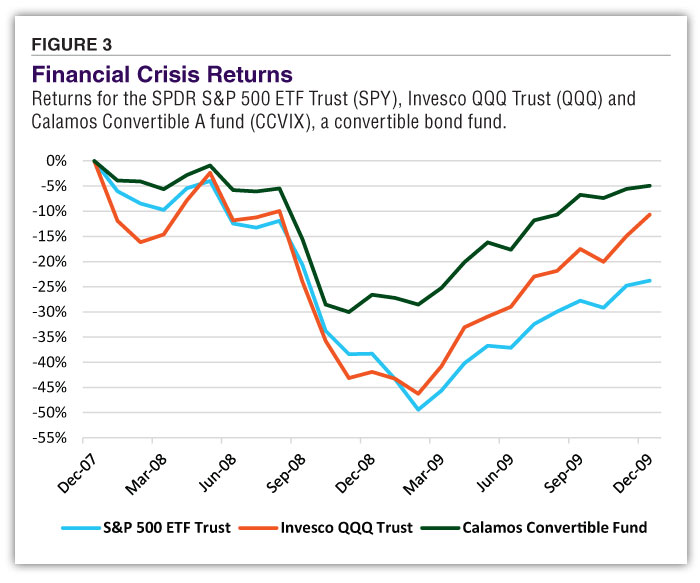

The Calamos fund also performed impressively during the 2008–2009 drop in equity prices caused by the financial crisis. Over the two-year period, the convertible fund had a price return of –5%, compared to the –10.7% return suffered by the tech-heavy Invesco QQQ Trust and the –23.8% return experienced by the large-cap SPDR S&P 500 ETF as shown in Figure 3. Since interest rates were lower than they were a decade earlier, however, the coupon income wasn’t sufficient to allow the convertible fund to have a positive total return for the period, losing 70 basis points (0.70%) over the two years.

Risks of Convertible Bonds

Convertible bonds tend to have shorter lives than other corporate bonds, reducing their sensitivity to changes in interest rates. They are very sensitive, however, to changes in the price of the associated equity. As a firm’s share price rises, it becomes more likely that the bond will be converted, leading to an increase in the bond’s price. This relationship can act as a hedge against rising interest rates. Although rising interest rates will cause the price of many bonds to fall, when interest rates are comparatively low, as is typically the case during and following a recession, an interest rate increase can lead equity prices, and therefore convertible prices, to rally.

While convertible bonds have less interest-rate risk than many other bonds, they tend to be issued by firms with low—or no—credit ratings and can expose investors to greater credit risk than the average corporate bond. Investors should note that holders of convertible bonds usually have a lower priority claim on assets than straight bond investors.

Convertibles can also carry significant equity risk. An investor who purchases a convertible bond trading at a significant premium to par faces the risk that a decrease in the firm’s stock price will cause the bond price to decrease toward its straight value. For example, an investor who purchased the Tesla bond in April 2021 at a price of $11,878 would face Tesla equity market risk. If the price of Tesla shares were to fall, say for example by 30%, from $736 to $515, the price of the bond would drop a similar percentage, and the investor would receive 16.138 shares worth $8,311 upon conversion.

Related

The price sensitivity of the bond to that of the underlying equity is reflected in the bond’s option delta. Ranging from near 0.0 for a junk convertible bond to near 1.0 for an equity-sensitive bond such as the Tesla convertible, the delta tells us the percentage change in the bond’s price for a given change in the stock price.

For example, the delta of the Ford bond is about 0.55, so that a one-dollar move in the price of Ford stock will cause the bond’s price to move by about $0.55. As you might infer from Figure 1, however, delta is not constant. It becomes smaller as the stock price decreases and the bond price approaches its straight value. The delta will approach 1.0 when the stock price appreciates significantly, and the convertible bond moves toward parity.

The delta for the Tesla bond, for instance, is 0.99 as I write this, and there is a correlation of about 95% between Tesla’s stock price and its convertible price. Delta is one of a number of option-related risk metrics that are collectively referred to as the “option Greeks.”

Summary

Convertible bonds offer intriguing opportunities for investors, offering an attractive risk/return tradeoff. They provide some protection from interest-rate risk, while offering the potential for equity-like returns with lower volatility, in return for a lower coupon. Although they are classified as fixed-income instruments, investors should be aware of their equity-like risk and return characteristics.

For most investors, it probably makes sense to gain exposure to convertibles using a mutual fund or exchange-traded fund (ETF), since individual convertible bonds require sophisticated analysis. In addition, convertible bond issuers tend to have low credit ratings, or to be unrated, so diversification is prudent. A mutual fund or ETF can provide this diversification for much fewer dollars compared to that required to purchase individual convertible bonds.

You should, however, take care if investing in convertibles to ensure that the mutual fund or ETF you are considering contains bonds that are not trading at significant equity premiums, because these can expose you to price shocks in the event of an equity market decline. Nevertheless, convertible bonds can have a place in a diversified portfolio.

Compare Convertible Funds at AAII’s Fund and ETF Guides

Select Allocation under Expanded Listings, then choose Convertibles from the Category drop-down list on the left. As of April 30, 2021, there are 38 convertible bond funds and four convertible bond ETFs in the universe.

Want to continue reading?

Want to continue reading?

Learn more from this educational AAII article, "Inside Convertible Bonds: An Attractive Risk/Return Tradeoff," AND gain access to exclusive AAII member-only content.

Brian Haughey CFA, FRM, CAIA, is a contributing editor to the AAII Journal. He is an assistant professor of finance and director of the Investment Center at Marist College in Poughkeepsie, New York.

No comments:

Post a Comment