For your weekend reading, I submit this week's latest offerings from the AAII, something I'm sure everyone can use -- an investor's guide to 2020 tax planning. The link and full text of the article is below. Enjoy your weekend, wet though it may be. (better rain than snow! - though I just had my snow tires put on so I don't care one way or the other.)

12-8-20 The Individual Investor’s Guide to Personal Tax Planning 2020 | AAII

The Individual Investor’s Guide to Personal Tax Planning 2020

by AAII Staff

Just as taxpayers were adjusting to the Tax Cuts and Jobs Act (TCJA) of 2017, two additional changes were made to the tax code. The SECURE Act addressed retirement savings and was signed into law in December 2019. The CARES Act provided relief during the coronavirus pandemic and was signed into law in March 2020. Both had a smaller impact on the tax code than the TCJA but still created questions for many individual investors. In response, we published an update to the tax rules in the May AAII Journal (“Tax Guide Update: Staying Current on the New Rules”). This guide incorporates many of those changes.

Due to the impact of those changes, Form 1040 was revised. It now includes a line for you to enter your “recovery rebate credit.” This is the stimulus check you may have received in the spring. The credit is based on your 2020 adjusted gross income (AGI) but was paid out based on your 2019 tax return (or your 2018 return if you had yet to file your 2019 return at the time the payment was calculated). If your AGI declined this year (2020), you may be able to claim a larger credit than you previously received. If your AGI increased this year, the draft instructions for Form 1040 state that “you don’t have to pay back the difference.”

The rebate credit does not count as income and is not taxable.

The other line added to the 2020 Form 1040 is for charitable deductions. This year, taxpayers can deduct up to $300 in charitable donations even if they take the standard deduction. The $300 limit applies to both single filers and joint filers. Married couples filing joint returns cannot double the deduction.

Required minimum distributions (RMDs) were waived in 2020. The waiver also applies to inherited IRAs subject to RMDs. RMDs for all accounts subject to the mandatory withdrawals will return in 2021. As a reminder, the age for starting RMDs is now 72. (It was 70½ for those who had attained that age in 2019 or earlier.)

Revised life expectancy tables used to calculate RMDs will go into effect in 2022. They assume longer life-spans and will lead to modestly smaller RMDs. Many retirees may not notice a change, however. This is because RMDs are calculated based on account balances. To the extent that a retiree’s balance increased for an account subject to the RMD rules, the amount of the mandatory distribution will increase as well.

Revised life expectancy tables used to calculate RMDs will go into effect in 2022. They assume longer life-spans and will lead to modestly smaller RMDs. Many retirees may not notice a change, however. This is because RMDs are calculated based on account balances. To the extent that a retiree’s balance increased for an account subject to the RMD rules, the amount of the mandatory distribution will increase as well.

The SECURE Act reduced the floor for deducting medical expenses to 7.5% of AGI for the years 2019 and 2020. The floor will revert back to 10% in 2021 barring new legislation. The CARES Act expanded the list of qualified medical expenses. See IRS Publication 502 Medical and Dental Expenses for a list of what is and isn’t covered.

Other so-called tax extenders are set to expire at the end of 2020. They include the ability to deduct mortgage insurance premiums.

A prior change to the kiddie tax was repealed. Minors’ unearned income is being taxed at their or their parents’ tax rate, whichever is higher. The TCJA had previously applied the trust and estate tax rates to minors’ unearned income. The change is retroactive to both 2018 and 2019.

As we wrote this guide, the presidential election had been called for Joe Biden. Control of the Senate had yet to be determined with two run-off races scheduled for Georgia. The best-case scenario for the Democrats would be a split Senate with vice president-elect Kamala Harris being a potential deciding vote.

Under this scenario, it will be politically difficult to pass significant tax legislation—particularly legislation raising tax rates on corporations and high-income earners. Should Republicans maintain control of the Senate, it will be even harder to implement the tax law changes president-elect Biden ran on.

This isn’t to say there won’t be any changes. Even with coronavirus vaccines coming, Congress could provide additional economic stimulus. This type of legislation may renew expiring tax extenders.

A case seeking to invalidate the Affordable Care Act is before the U.S. Supreme Court. A reinstatement of a penalty for not having health insurance could potentially render the lawsuit moot. From a tax standpoint, were the law to be fully invalidated by the court, the 0.9% additional Medicare tax and the 3.8% surtax on net investment income (NII) for high earners would end without new legislation.

The reduced tax rates and expanded tax brackets for individual taxpayers put into place by the TCJA are set to expire at the end of 2025. It is possible that this expiration could be addressed prior to the 2024 elections. Doing so will likely require bipartisan compromise in an environment that has largely lacked it.

If you worked remotely or resided in a state other than your primary work/residence state, you may owe state taxes. Whether you do depends on how you worked or resided in a different state.

If you owed more than expected or received a larger-than-expected refund for the 2019 tax year and haven’t adjusted your withholding, consider doing so. The IRS’ Tax Withholding Estimator can help you run the numbers. In doing so, make note of any changes in your income for this year attributable to the coronavirus pandemic.

Early statistics from CapGainsValet figure 2020 to have fewer large mutual fund distributions than 2019. As of November 18, 137 mutual funds announced estimated distributions over 10%. In comparison, 154 funds announced distributions over 10% at a similar point in 2019. These distributions are taxable for shares held in a taxable account—even if you don’t sell your shares of the mutual fund issuing the distribution or choose to have the distributions reinvested. You can find the tax-cost ratio—the percentage of returns given up to taxes—for a mutual fund or an exchange-traded fund (ETF) on our mutual fund and ETF evaluator pages. To access the evaluator, just type a fund’s name or ticker symbol into the search box located at the top of any page on AAII.com.

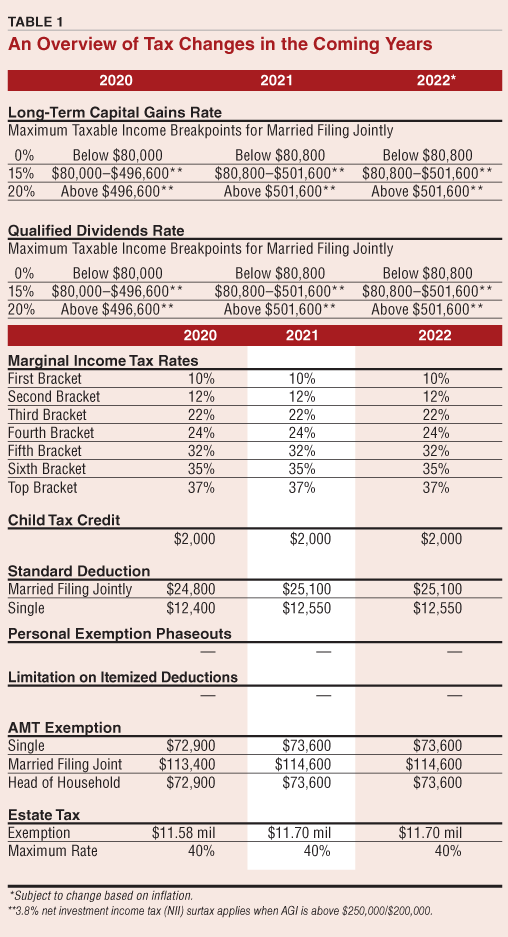

The TCJA mandated the use of the chained consumer price index (CPI) for measuring inflation. This figure rises more slowly than the traditional CPI, and many line items will increase by just 1.5% or less in 2021 as a result. The small increases follow the 2020 increases of mostly 1.6%. The cumulative impact will cause those whose income rose at a faster rate to pay more in tax. It may even bump some into a higher tax bracket.

Those of you who were affected by hurricanes, wildfires, tornados or the derecho may be eligible for some form of tax relief. The IRS has a dedicated section on its website with links to specific pages for each disaster: www.irs.gov/newsroom/tax-relief-in-disaster-situations.

No matter how the tax laws (and tax forms) evolve in the future, one thing is constant: You will still have to pay taxes. Even with the simplifications made by the TCJA, the tax code is complex; hence the need for tax guides. As has been the case in years past, our tax guide provides an overview of the tax rates and deductions likely to impact the majority of AAII members. Since there are many details, loopholes and pitfalls within the tax code, it is impossible for this guide to provide enough details to cover specific tax situations. If you have questions, consult a tax professional. It is your tax return, and the IRS will hold you responsible for any errors made on it.

A special note of thanks goes out to Mark Luscombe, a principal analyst at Wolters Kluwer Tax & Accounting, for previous assistance in answering detailed questions about the tax code. Sources of information used for this year’s guide also include the Internal Revenue Service, Healthcare.gov, Medicare, the Social Security Administration, the Federal Register and The Kiplinger Tax Letter.

No comments:

Post a Comment