A while back we talked about the AAII's Wayne Thorp's 10 rules of investing. As I feel it's a good idea to get back to basics from time to time, this week, the AAII published an expansion on this topic. Have a great weekend.

AAII

Thursday, October 26, 2023 |

Expanding Upon the 10 Commandments of Investing |

Join Raymond Rondeau, Wayne Thorp and me at the MoneyShow in Orlando, Florida, from October 29 through October 31, 2023! We are thrilled to share invaluable strategies, covering effective market timing; wealth building; investor sentiment interpretation; dividend investing principles; value, momentum and quality; and sustainable growth investing. Dive into a wealth of knowledge and gain insights to refine your investing approach. Click here for more information. One month ago, I shared AAII founder James Cloonan's 10 commandments of investing. The article elicited comments and emails from members. As luck would have it, I came across two follow-up articles by Cloonan about those commandments while looking through the 1981 and 1982 issues of the AAII Journal. |

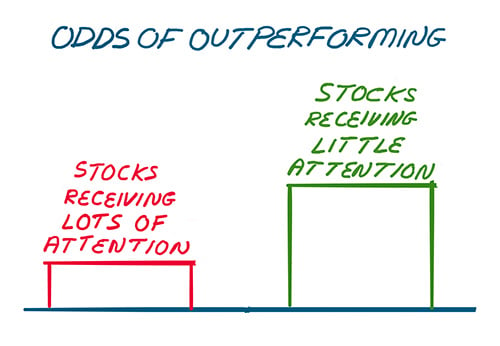

My intention when looking at those back issues was to see what was written about the bond market back then. Those of you who are old enough will remember that yields on the benchmark Treasury bond peaked in 1981. The 10-year bond ended 1981 with a yield of 13.92%. New home mortgage rates were even higher at 14.70%. (Yikes!) I didn't find what I was looking for on the bond front. (I may have to look at other issues from that time period.) What I came across were two “Matter of Opinion” articles about the investing commandments in the March and April 1982 AAII Journal issues. In both, Cloonan expounded on his rules after having received “quite a number of responses” from AAII members. About half of those responses “were in the form of questions regarding the rationale for our statements, while the other half represented disagreements with the commandments.” Here is a summary of what Cloonan further said about his 10 commandments of investing. 1. Diversify—He believed in holding “a minimum of seven different stocks” and felt that “10 to 15 is ideal.” If those numbers seem low, understand that Cloonan viewed the difference between owning seven and 30 stocks as being “probably insignificant when compared to the difference between having only a couple stocks and having at least seven.” 2. Never buy preferred stocks—This rule was centered on risk. Relative to bonds issued by the same corporation, the additional risk of preferreds at that time was “not accompanied by additional yield.” Cloonan cited the tax advantages corporations receive on dividend income relative to interest income as playing a role in reducing the yield on preferred stocks. 3. Never put a substantial portion of your wealth in the stock market or take it out at one point in time. Ease in. Ease out—Business cycles have lasted three to five years on average. Spreading out the timing of transactions eliminates “the possibility of buying everything at the high or selling it at the low.” 4. Never invest any money in common stocks that you feel you will need in less than four years—The same logic regarding the three- to five-year length of business cycles applies here. 5. Never buy a stock that is getting favorable publicity in the press—“There was more debate about our fifth rule,” wrote Cloonan. “The basic reason for this rule is our belief that if an individual is going to outperform a dart thrower (the stock market averages), then they must also find stocks that are undervalued.” Stocks receiving lots of publicity are being looked at by many investors whose collective opinions have been priced into the valuations of those stocks. Cloonan added, “The real opportunity to outperform comes from discovery, not from being a follower.” 6. Never buy a stock that is recommended on a nonsolicited basis by a brokerage firm—The same belief about looking at stocks that have received less attention applies to this rule. Cloonan thought he should “probably amend” the rule to “include just major brokerage firms and extend it to include those widely followed investment advisory publications that single out only a few stocks as special.” 7. Never buy a stock that is included in the S&P 500 index—There are three reasons as to why. First, the likelihood of any of these stocks being “significantly undervalued” is small. Second, “there is little chance of any of these stocks increasing tenfold in the future.” Third, institutional investors hold large-cap stocks but “have more difficulty investing in smaller companies.” 8. Never buy “safe” or low-risk stocks—Cloonan thought investors should instead “establish an appropriate (level of) portfolio risk between growth stocks and minimal risk investments.” He used the example of combining higher-risk stocks (e.g., undervalued small-company stocks) with Treasury bills to achieve the same portfolio beta (volatility) as a diversified large-company portfolio. Cloonan thought such stocks would outperform over the long term, while the Treasury bills (or other money market instruments) may see their yields rise when the stock market is down. 9. Don’t buy a stock in the year following a presidential inauguration—“The ninth rule … is difficult to rationalize,” admitted Cloonan. Though the timing of such downturns in the second year of a presidential term has varied, the length, speed and sharpness of such moves warrant patience among investors. This rule just applies to purchases: “We don’t suggest getting out of stocks completely.” 10. Don’t believe in anyone else’s system for making a “killing” in the market. If you find such a system, write me “confidential” from your yacht and send your jet for me to come and discuss it—Though offered in humor, it was included to warn investors against such pitches. Cloonan added that if he had a system that could return 40% per year from investing in stocks (or commodities), “the one thing I wouldn’t do would be to sell my system or discuss it.” |

No comments:

Post a Comment