For your reading pleasure this weekend I have discovered an article from this week's AAII which talks about one of our favorite topics -- ETFs. Since most of us favor ETFs, this should provide a very good review and primer regarding the process of selecting ETFs and mutual funds. Enjoy the beautiful weekend.

8-27-20 AAII Investor Update

| |  |

|  AAII Investor UpdateTHURSDAY, AUGUST 27, 2020 AAII Investor UpdateTHURSDAY, AUGUST 27, 2020

| |

| | |

| | |

| |

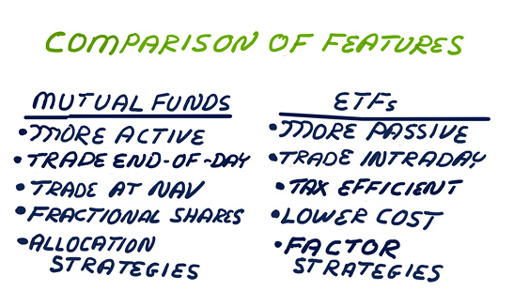

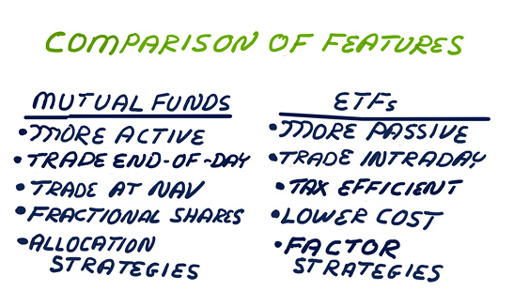

Dear Member, If your investing plan calls for incorporating funds into your portfolio strategy, you will first need to answer two basic questions: Which areas of your allocation are looking to fill? Are you going to invest in mutual funds or exchange-traded funds (ETFs)? The process of picking a fund should always start with your allocation strategy. Researching a great-performing small-cap value fund when you need to fill the bond component of your portfolio doesn’t help much. It’s akin to looking at kitchen appliances when your air conditioner has stopped working in the middle of the summer heat; you should focus on finding someone who does air conditioning repairs.  Once you decide which asset class to target, you can start to drill down by fund group and category. From there you can pick the best fund for your needs. Look at returns over several time periods (as opposed to simply one year or even shorter time periods), the level of risk relative to peers and the expense ratio. If the fund is to be held in a taxable account, look at the tax-cost ratio. These analyses can be done using our mutual fund and ETF comparison tools. You can find even more useful tools and data—including lists of consistent performers and performance benchmarks—in the mutual fund and ETF sections of AAII.com. Your choice of which type of fund to invest in starts with the account you are using. Participants in workplace retirement plans like 401(k) plans are generally limited to mutual funds. Most robo-advisers use ETFs. If you have an account with a mutual fund provider, then your options depend on the company. If your account is with a mutual fund company without a brokerage arm (e.g., T. Rowe Price), then you are limited to mutual funds. Fidelity and Vanguard are among the small group of fund families to allow taxable, IRA and Roth IRA account holders (as well as those with similar types of accounts) to buy stocks, ETFs or mutual funds. Once you decide which asset class to target, you can start to drill down by fund group and category. From there you can pick the best fund for your needs. Look at returns over several time periods (as opposed to simply one year or even shorter time periods), the level of risk relative to peers and the expense ratio. If the fund is to be held in a taxable account, look at the tax-cost ratio. These analyses can be done using our mutual fund and ETF comparison tools. You can find even more useful tools and data—including lists of consistent performers and performance benchmarks—in the mutual fund and ETF sections of AAII.com. Your choice of which type of fund to invest in starts with the account you are using. Participants in workplace retirement plans like 401(k) plans are generally limited to mutual funds. Most robo-advisers use ETFs. If you have an account with a mutual fund provider, then your options depend on the company. If your account is with a mutual fund company without a brokerage arm (e.g., T. Rowe Price), then you are limited to mutual funds. Fidelity and Vanguard are among the small group of fund families to allow taxable, IRA and Roth IRA account holders (as well as those with similar types of accounts) to buy stocks, ETFs or mutual funds. |

|

No comments:

Post a Comment