Here we go again with the weekly summation, the main positive being increasing signs of a decisive election result, the big negative remaining that jobless claims continue to rise (and, of course - the historic first! -- in 7 decades of televised presidential debates, the first ever to be canceled.) The bonus this Sunday is another cool little graphic that puts things into badly needed perspective -- a visual on the 200 year history of interest rates in the United States. Enjoy and hope you all enjoyed your weekend.

Succinct Summation of Week’s Events for 10.16.20

Succinct Summations for the week ending October 16th, 2020

Positives:

1. Increasing signs of a decisive, earlier election result harkens markets.

2. Retail sales rose 1.9% m/o/m, above expected increase of 0.7%.

3. Import prices rose 0.3% and export prices rose 0.6% m/o/m.

4. PPI-FD rose 0.4% w/o/w, above the expectations.

5. Consumer sentiment is at 81.2 for October, above the expected 80.5.

Negatives:

1. In 7 decades of televised presidential debates, this was the first one ever to be cancelled.

2. Jobless claims rose 53k w/o/w from 845k to 898k, above the expected 825k.

3. Home mortgage apps fell 2.0% w/o/w; Home refinance apps fell 0.3% w/o/w.

4. CPI rose 0.2% m/o/m, below the previous increase of 0.4%.

5. Industrial production fell 0.6% m/o/m, below the expected increase of 0.6%.

6. Business inventories rose 0.3% m/o/m, below the expected increase of 0.4%.

Thanks, Matt!

10-18-20 Visualizing the 200-Year History of U.S. Interest Rates - The Big Picture

Visualizing the 200-Year History of U.S. Interest Rates

Source: Visual Capitalist

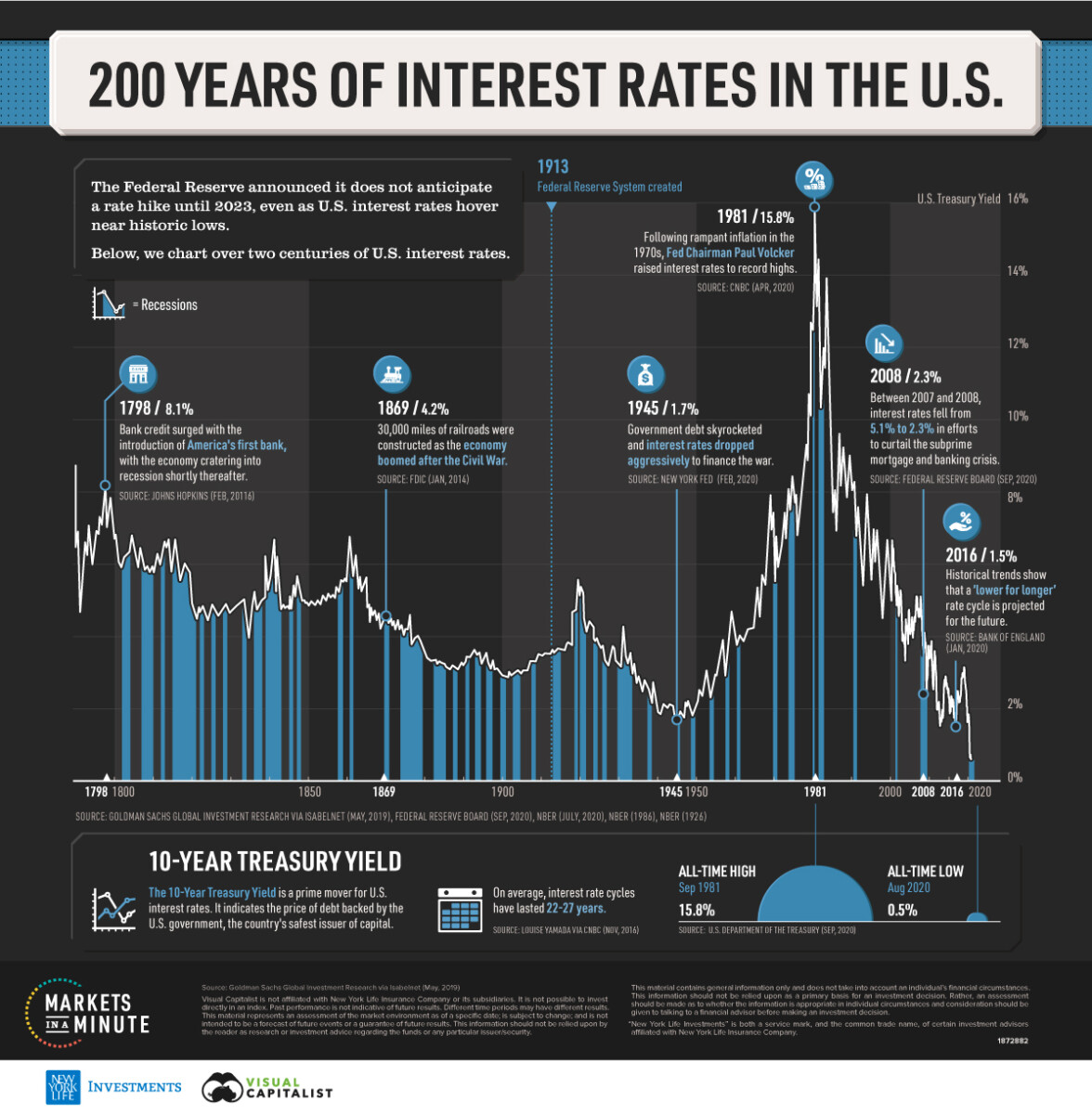

I am out of pocket most of today, but I wanted to share a quick note on the long-term history of Interest rates, as seen in the above history.

Three things stand out :

1) From 1790 to 1950, the overall trend was towards lower rates.

2) The 1970s-80s inflation/yield spike was historically aberrational.

3) 2009-present zero interest rate regime is utterly unprecedented .

Just because something has not happened before does not mean it won’t happen. The “Unprecedented” occurs all the time.

Here is Visual Capitalist‘s take:

What are the highest and lowest rates throughout history?

Prior to today’s historically low levels, interest rates fell to 1.7% during World War II as the U.S. government injected billions into the economy to help finance the war. Around the same time, government debt ballooned to over 100% of GDP.

Fast-forward to 1981, when interest rates hit all-time highs of 15.8%. Rampant inflation was the key economic issue in the 1970s and early 1980s, and Federal Reserve Chairman Paul Volcker instigated rate controls to restrain demand. It was a period of low economic growth and rising unemployment, with jobless figures as high as 8%.

The 30,000 foot view gives a unique perspective…

No comments:

Post a Comment