From this week's AAII, a memorial to Charlie Munger, second-in-command to Warren Buffett at Berkshire Hathaway who passed away this past week at the age of 99 and 11 months.

Thursday, November 30, 2023 |

Remembering Charlie Munger |

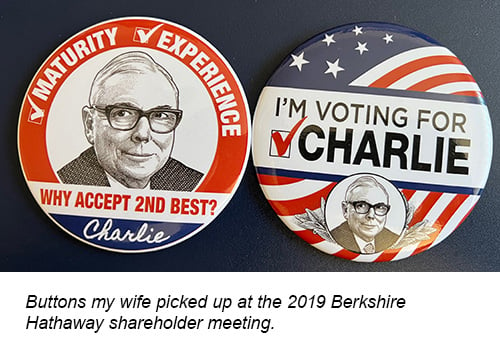

AAII is excited to be participating in Finimize's Modern Investor Summit 2023 on December 5 and 6, and you are invited to join us. This FREE virtual event is a unique opportunity to hear from industry titans like keynote speakers Ray Dalio and Jamie Dimon, as well as our own Wayne A. Thorp, who will offer insights on stock screening and investment strategies. Click here to learn more and secure your FREE virtual ticket. As you have probably heard by now, Berkshire Hathaway vice chairman Charlie Munger died on Tuesday, November 28, 2023. He was just a month shy of reaching his 100th birthday. With his passing, the world lost a legendary investor and a man full of insight and wit. “If people weren't so often wrong, we wouldn't be so rich,” he once quipped. Munger's wit quickly turned my wife into a fan of his. Ask her about Berkshire Hathaway and she'll quickly say, “Charles greatly admires Warren Buffett, but I love Charlie Munger.” |

Munger was more than Buffett's business partner and friend. It was Munger who convinced Buffett to evolve his strategy from Benjamin Graham's deep-value approach to paying up for good companies. This shift was first apparent with Berkshire Hathaway's purchase of See's Candies in the 1970s. See's Candies was what Robert Hagstrom described as a “high price-to-book business—almost the antithesis of the Graham methodology” in the November 2021 AAII Journal (“Warren Buffett and the Evolution of Value Investing”). |

No comments:

Post a Comment